Cross-price demand elasticity measures how sensitive is a demand for the product to a price change. Some goods can often be linked to each other in the market. This may mean that an increase in or fall in the price of a product may affect the other product’s demand positively or negatively.

The change in the price of a related commodity leads to changes in the demand for another good in the context of consumer behavior. There are two kinds of related goods, i.e. substitutes and additional goods. The elasticity coefficient of the cross is null if the two products are not related.

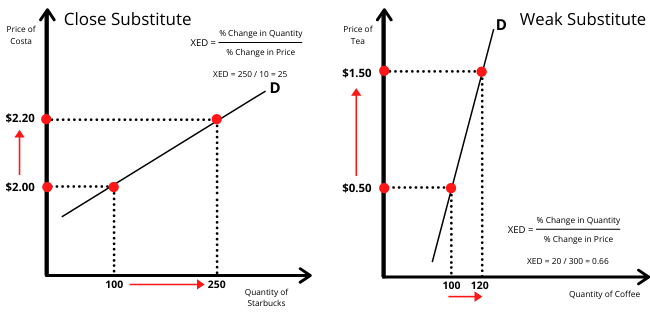

In the event of two products being substitutes like Tea and Coffee, there is a positive cross price elasticity of demand, i.e. if the coffee price increases, there is an increase in tea demand. On the other hand, if products are complementary such as pen and ink, the cross price elasticity of demand is negative and, if the price of the pen increases or vice versa, the demand for ink is reduced.

Brief Description of the cross price elasticity of demand

1. Cross Price Elasticity Of Demand Formula

The formula for the cross-price elasticity of demand is the percentage change in demand of the product X divided by percentage in the price of product Y

Cross elasticity of demand formula signifies the responsiveness of change of demand in product x to change in the price of product y

Then how does the practice work? Let’s take an instance

Let’s say the price of Coca-Cola is increasing 10%. Simultaneously Pepsi demand is increasing by 5%. We, therefore, divide the change in demand, which is 5%; by the rate change of 10%. With which we leave:

XED = 5% increase of Pepsi’s demand / 10% increase of the price = 0.5.

That’s fine, but what does it mean? Three categories can be the result:

XED > 0 — replacement goods are both products/services. This indicates the cross price elasticity of demand is positive.

XED < 0 – both products/services are additional items, indicating negative cross price elasticity of demand

XED = zero There is no link between the two products/services.

Varied Types of Cross Price Elasticity Of Demand

2. Cross Price Elasticity Of Demand – Positive

Price for positive cross formulation produces a result greater than 0 is the result of elasticity.

In the case of positive cross price elasticity of demand, where the cross-price demand elasticity of product A is relative to a price change for product B, the required quantity of product A is increased as a result of a product B price rise. Many consumers have moved from product B consumption to product A consumption. This means that most consumers view products A and B as alternatives that meet similar preferences.

Substitutes have a positive price cross or more than zero elasticity of demand.

McDonald’s, for example, can increase their prices by 20%. In turn, clients want to go to Burger King because they can offer a cheaper meal. Burger King, therefore, sees a 10 percent increase in demand. This shows that the relationship between them is positive.

3. Cross Price Elasticity Of Demand – Negative

When there is the adverse cross price elasticity of demand of product A demand relative to a price change of product B, it means that the required quantity of A has fallen as compared with product B’s price rise. Although product A prices are unchanged, many consumers have still lowered consumption, as the increase in product B prices made the combined consumption of these products more expensive. This implies that most consumers perceive A and B products as additional products which are consumed together more pleasantly than individually.

Additionals will always be negative, or less than 0 Cross Price Elasticity Of Demand.

For example something akin to an iPhone and an iPhone case. In essence, a consumer will not buy an iPhone case unless they first purchase an iPhone. As a result, the complementary good is dependent on the demand for the other.

When the price of an iPhone rises, demand tends to fall. Simultaneously, as fewer people purchase iPhones, fewer people purchase iPhone cases.

4. Cross Price Elasticity Of Demand – Unrelated

These are products that are unrelated to consumer patterns. Changing prices in one product do not affect the amount of the other product consumed.

Cross Price Elasticity Of Demand is always 0 Unrelated goods

They have no relationship when comparing the two products. For instance, two random products can be compared: milk and MacBook. The price of milk would have no impact on the number of MacBooks sold if it were to increase by 10 percent.

Read Here- Most Famous Car Logos List

Elastic Vs Inelastic Demand

A significant concept of demand is demand elasticity. Demand may be split between elastic, unitary, or inelastic demand. Demand elasticity refers to the extent to which supply and demand respond to another factor, such as price, income level, or availability of substitute products, etc. Demand inelasticity can be simplified because changing one or more determinants could change the product demand somewhat or nothing. Inelastic demand means that the demand for the price of the commodity changes slightly or not (either reduced or increased). Change of price percentage.

Example Of Elastic Vs Inelastic Demand

To demonstrate an example of elastic demand, the price of a well-established increase decreases by 1% and demand by 2%. The good has an elastic demand as demand has changed by more than price. On the other hand, if the price increases by 1% and demand fall by 0,5%, good demand is inevitable. If both price and demand change by 1%, unit elastic demand for the good is unitary.

The importance of cross-elasticity of demand

Knowing the elasticity of demand for a product across the price of other connected products enables a company to understand better the market it serves. This company will better identify how many competitors share the same product space in the view of consumers and how sensitive sales revenues are to changes in Complementary Product’s marketing strategies outside its own market. Companies use this information to develop targeted strategies that respond optimally to changes in the prices of competing and complementary products.

In the prediction of a change in the price of goods or its substitute and complementary products, the importance of cross price elasticity of demand is seen. The cross elasticity of demand also helps to determine the relationship between the two products and helps to determine whether they are either complementary or substitutes or fully independent of each other.

It also helps the organization anticipate the extent of the current market monopolies and competition. It is useful to predict which of the product will rise when there is a sudden shift in the market for which the product will fall or which product will remain independent of this particular and sudden shift in the market.

1. Complementary products

The Company can possibly combine these products to create additional demand. For instance, most retailers offer games on the Playstation. They usually offer a small discount on separate purchases which can help boost demand.

2. Pricing Strategy

The company can see how prices are reacted by consumers. Where Company A increases prices and sees products of Company B increasing demand, it demonstrates that this impact must be taken into account.

3. Organizational Strategy

If this occurs with complementary products from alternatives, they can look to integrate if the company can identify crucial areas. This can happen by acquiring, merging, and acquiring other companies in the supply chain.

Uses & Inferences

A company must be aware of the cross-elastic demand for a product or service. Cross-elastic demand can help firms pricing and identify other people’s sensitivity to their products. For example, a strategic “loss leader” deliberately benefits from the negative cross price elasticity of demand for complementary goods. A company may sell one of its products at a lower cost and thus promote sales of its complementary products. In the business of its key products, big profits for complementary products can compensate for net losses.

This strategy is used by many large companies, such as Sony. The PlayStation consoles of Sony are sold at a lower cost to promote the sale of games. Games and consoles complement almost perfectly. The decrease in console prices will increase the demand for games significantly. Sony can make big profits in games to make up for its net losses in the console business.

In addition, unique products that cannot be replaced allow companies to sell their products at higher prices. Due to the product’s uniqueness, companies are not too concerned about the change to another product from consumers. The price-setting should, however, also follow the commodity demand curve. Suppose the demand elasticity of the product exceeds 1. In that case, slight price changes will cause the consumer demand for the product to be reduced significantly. So, before setting prices, companies should first study carefully the demand elasticity of their products.

It provides the company with a wider profit range. A true example of this is Apple. At the start of their phones, Apple used iOS that is different from Android. This system’s clean, simple interface is an irreplaceable advantage. Apple has its unique tone and calls ringtone for text messages. Apple is creating uniqueness in many small ways. Telephone users using iOS have a habit of adapting to other systems, such as Android or Huawei HarmonyOS.

Key Takeaways

The study of the term cross-elasticity demand played an important role in estimating the impact on demand of their substitutes and complementary goods of a change in the price of a good. Thus, by determining the change in demand for a product’s substitutes, it helps to determine the price of the goods.

Besides this, cross-elasticity of demand helps to determine whether they are substitutes, complimentary, or different from one another for the nature of the relationship of two goods. It allows an organization also to anticipate the intensity and scope of the monopoly and competition on the market.

- Cross price elasticity of demand measures how sensitive a product’s demand is to a change in the price of a product.

- An increase in the price of a complementary product will result in reduced demand or negative price elasticity, and a rise in the price of a substitute will result in an increase in demand or a positive cross price elasticity of demand.

- No cross price elasticity of demand is associated with unrelated products.